This 2025 aftersales service recap reflects a reality-check year for enterprise IT and service organizations across manufacturing and automotive industries. While demand for service remained resilient across manufacturing and automotive sectors, organizations faced mounting constraints: workforce shortages, rising asset complexity, tighter capital discipline, and increasing regulatory pressure.

AI adoption moved from experimentation to selective, utility-driven use cases, while large-scale transformation programs slowed in favor of initiatives with measurable operational impact. At the same time, policy shifts such as Right to Repair and macroeconomic uncertainty reshaped service economics and competitive dynamics.

The defining characteristic of 2025 was not innovation speed, but execution discipline. Service emerged as a strategic system constrained by data, people, and operating models, thus setting the foundation for how leading organizations will compete in the years ahead.

2025 in one sentence: Ambition gave way to operational realism – especially in service.

Why 2025 Felt Different

Enterprise leaders entered 2025 with high expectations. Generative AI, digital twins, and autonomous operations promised step-change improvements in productivity and customer experience. Yet by mid-year, the narrative shifted.

Across industries, organizations confronted the same reality: technology readiness outpaced organizational readiness. Data fragmentation, process variability, and talent shortages constrained scale. As a result, leadership attention moved away from experimentation toward fundamentals, particularly in service where cost, customer impact, and operational risk intersect most visibly.

Nowhere was this shift more apparent than in aftersales and field service operations.

What Actually Happened in 2025

Aftersales Demand Remained Strong but Complexity Increased

In 2025, aftersales demand remained resilient across manufacturing and automotive sectors, defying periodic predictions of decline. However, delivering service profitably became more difficult as asset complexity, mixed fleets, and connected products increased operational burden. Service organizations were asked to do more, not necessarily with fewer resources, but under tighter margin and reliability expectations.

Manufacturers and OEMs faced:

- Mixed asset populations (ICE, hybrid, EV, connected equipment)

- Higher diagnostic and training requirements

- Greater variability in parts availability and service workflows

Service organizations were asked to do more but not necessarily with fewer resources, but under tighter margin and reliability expectations.

Service Workforce Shortages Became Structural

Workforce constraints moved from a temporary concern to a structural limitation in 2025. Across regions, the gap between experienced technicians exiting the workforce and new talent entering continued to widen. As a result, service capacity, responsiveness, and transformation pace increasingly depended on productivity rather than headcount growth.

What changed in practice:

- Retention, enablement, and productivity overtook headcount expansion as leadership priorities

- Experienced technicians retired faster than new talent could be onboarded

- Hiring at scale proved unrealistic in most regions

AI Shifted from Vision to Utility

The role of AI in service changed materially in 2025. Rather than broad transformation narratives, organizations focused on narrow, defensible use cases tied directly to operational performance. The emphasis shifted from experimentation toward utility, where AI could demonstrably improve service outcomes.

Common areas of progress included:

- AI-assisted scheduling and dispatch

- Predictive maintenance where asset data was reliable

- Knowledge search and technician assist tools

- Warranty and failure-pattern analytics

Equally important were the initiatives that stalled. Many pilots did not scale, not because AI underperformed, but because data quality, process clarity, and governance were insufficient.

AI success in service became less about models, and more about organizational readiness

Right to Repair Began Reshaping Aftersales Economics

Regulatory developments around Right to Repair gained practical relevance in 2025, reshaping competitive dynamics in the aftermarket. Expanded access to parts, tools, and repair information increased pressure on traditional revenue models. For many OEMs and manufacturers, this accelerated a shift toward differentiation through service execution rather than exclusivity.

The implications for OEMs and manufacturers were material:

- Greater competition in aftermarket services

- Increased pressure on parts-led revenue models

- Heightened importance of service experience, uptime, and performance guarantees

Leading organizations responded not by resisting change, but by re-anchoring differentiation around outcomes rather than access.

Macro Pressures Influenced Service Investment Decisions

Broader macroeconomic forces played a quiet but decisive role in shaping service investment decisions throughout 2025. Tariff uncertainty, higher capital costs, and geopolitical risk reinforced capital discipline across industries. Service leaders increasingly prioritized initiatives with clear, near-term returns over large, multi-year transformation programs. Beyond service-specific dynamics, broader macroeconomic forces shaped decisions throughout 2025:

- Ongoing tariff uncertainty and geopolitical risk

- Higher cost of capital

- Increased scrutiny of large transformation programs

As a result, service leaders prioritized fewer initiatives with clearer ROI, often favoring incremental productivity gains over multi-year platform overhauls.

What Didn’t Happen (Despite High Expectations)

Several highly anticipated developments failed to materialize at scale in 2025. Expectations around autonomous service operations, seamless enterprise-wide data platforms, and large-scale workforce displacement proved premature. Importantly, these gaps were driven less by technology limitations and more by unresolved organizational and structural constraints. Several widely anticipated developments failed to materialize at scale in 2025:

- Fully autonomous service operations

- Seamless, cross-functional data platforms

- AI replacing large portions of the service workforce

These outcomes were not delayed due to lack of technology, but due to unresolved organizational and structural constraints. This gap between expectation and execution provides important context for interpreting leadership behavior.

In 2025, service excellence became less about innovation speed and more about execution under constraint.

How Leading Manufacturers Approached Service Transformation

Despite shared constraints, some organizations consistently outperformed peers. The difference was not investment size, but how decisions were made.

They Treated Service as a System

Leading organizations approached service as an end-to-end lifecycle capability rather than a collection of tools or functions. They emphasized continuity across design, operations, and service delivery, recognizing that field performance is shaped well before an asset reaches the customer. This systems view underpinned more durable service improvements. This pattern was visible across industrial leaders such as Siemens and Honeywell.

They Invested in Productivity, Not Headcount

Facing persistent workforce constraints, leaders shifted focus from hiring to enablement. Investments prioritized diagnostic intelligence, remote support, and standardized processes that allowed existing technicians to do more with less friction. Productivity, not scale, became the primary lever for service resilience. Organizations such as ABB and Daimler Truck focused on enabling technicians through diagnostics, remote support, and standardized processes rather than expanding teams.

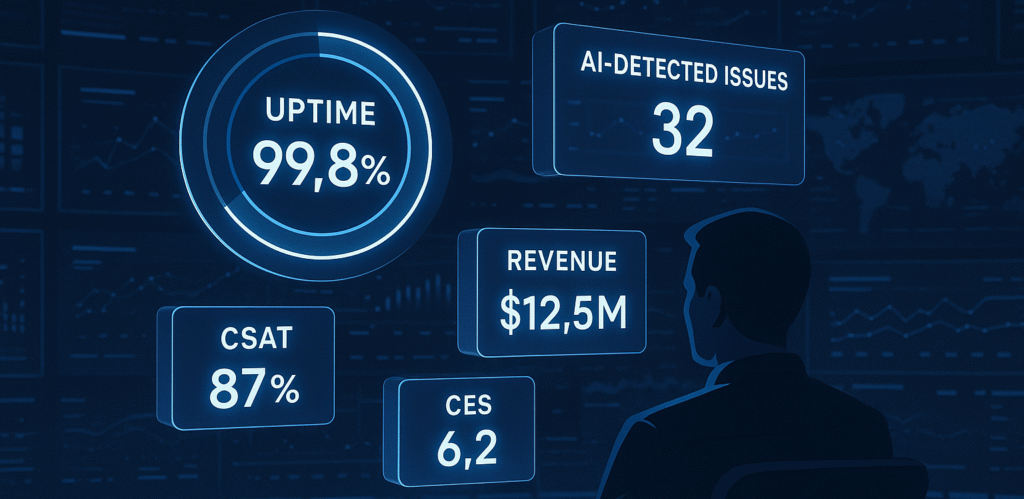

They Anchored AI to Operational KPIs

Rather than positioning AI as a standalone transformation initiative, leading automotive OEMs including Ford and Stellantis tied it explicitly to operational metrics. Success was measured through improvements in MTTR, FTFR, uptime, and warranty performance. This KPI-driven framing helped separate scalable value from experimentation.

They Leaned into Regulatory Reality

Instead of resisting Right-to-Repair dynamics, leaders like Trane Technologies adapted their service strategies to the new environment. Outcome-based contracts, faster turnaround times, and differentiated service experiences became central to maintaining competitive advantage. Regulation was treated as a design constraint, not a strategic threat.

They Chose Fewer Bets and Executed Them Well

Perhaps the most underappreciated leadership shift in 2025 was restraint. Organizations reduced the number of parallel initiatives and concentrated execution capacity where impact was measurable. Focus, rather than ambition, became the defining trait of high-performing service organizations.

| What Happened in Aftersales & Service in 2025 | What Leading Organizations Did Differently |

|---|---|

| Service demand remained strong, but asset and fleet complexity increased across industries. | Designed service as an end-to-end lifecycle system rather than optimizing isolated tools or functions. |

| Technician shortages became structural, limiting service capacity and responsiveness. | Focused on technician productivity, enablement, and assisted service models instead of headcount growth. |

| AI pilots proliferated, but many failed to scale beyond experimentation. | Anchored AI investments directly to service KPIs such as MTTR, FTFR, uptime, and warranty cost. |

| Data fragmentation constrained automation and end-to-end visibility. | Standardized processes and clarified data ownership before expanding digital initiatives. |

| Right-to-Repair regulations increased aftermarket competition. | Differentiated through service experience, speed, and outcome-based contracts. |

| Capital discipline tightened amid macroeconomic uncertainty. | Chose fewer service initiatives and executed them with measurable ROI. |

What This Means for Enterprise Leaders

By the end of 2025, a clear message emerged: service is no longer a peripheral function. It is a strategic system that reflects an organization’s ability to execute under real-world constraints.

- The organizations best positioned going forward are those that:

- Align service strategy with regulatory and economic realities

- Treat service data as strategic infrastructure

- View workforce capability as a limiting factor, not a variable

- Apply AI selectively, tied to outcomes

2025 did not deliver dramatic breakthroughs in enterprise IT or service. Instead, it exposed the limits of ambition without execution.

For many organizations, this was a necessary reset. The next phase of value creation will not come from chasing the next technology wave, but from strengthening the fundamentals that allow service to scale reliably, profitably, and credibly.

Note:

Company examples referenced are based on publicly available strategy disclosures, annual reports, and product documentation, and are intended to illustrate broader industry patterns rather than provide a comprehensive assessment of individual organizations.