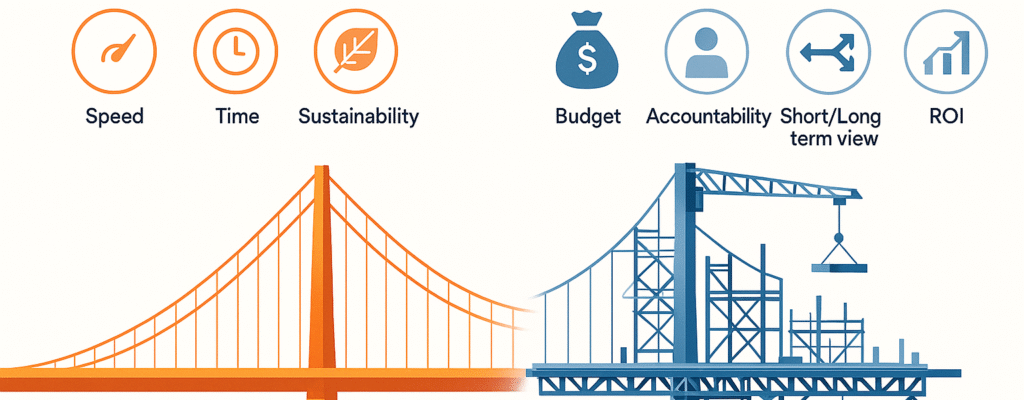

The “honeymoon phase” of Generative AI is over. For service leaders in the manufacturing and automotive sectors, 2025 was a year of frantic experimentation. But as we enter 2026, the mandate has shifted from curiosity to Operational Accountability.

We are entering the era of Agentic Execution. In this landscape, the products we maintain are software-defined, the talent pool is permanently constrained, and the customer no longer buys a “machine” – they buy a guaranteed outcome. For the modern service leader, the focus is clear: service is no longer a support function; it is the primary guardian of Customer Lifetime Value (CLV) and the only reliable engine for high-margin growth.

Beyond the Copilot: Orchestrating Agentic Service

We spent the last decade chasing “Predictive Maintenance,” but prediction without frictionless action is just a sophisticated way of watching things break. In 2026, leading organizations have moved to Multi-Agent Systems (MAS). These are not chatbots that offer advice; they are autonomous software entities with the authority to execute. However, autonomy requires a new financial guardrail. This is Industrial FinOps- the practice of managing the ‘unit economics of intelligence’ to ensure that the cost of AI inference and cloud compute never outpaces the operational value created.

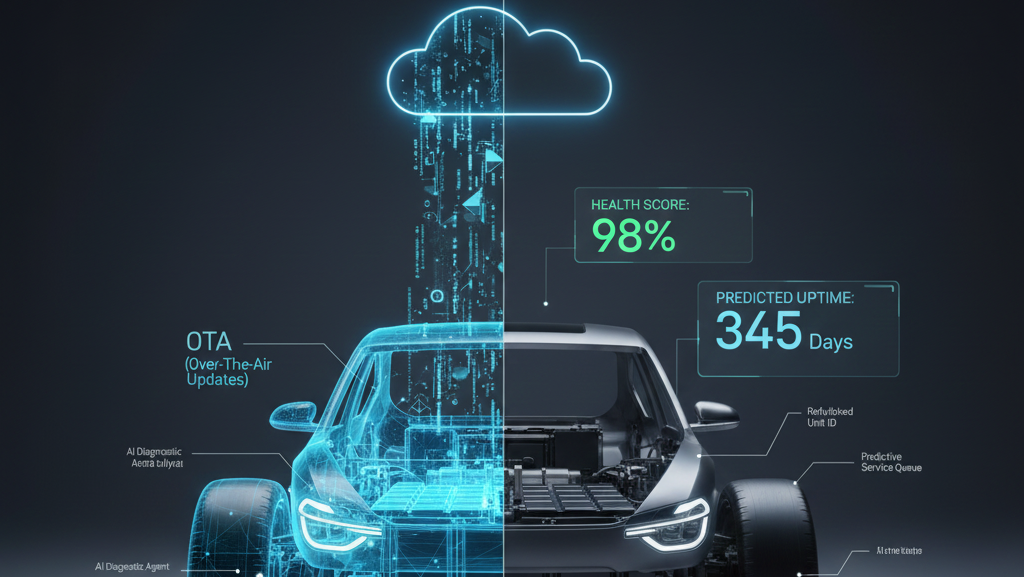

When a sensor detects a vibration anomaly, an agentic workflow doesn’t just alert a human. It autonomously cross-references the technical fault with the global supply chain, reserves a refurbished part, and negotiates a service window directly with the customer’s production schedule. By removing the administrative “latency” between a signal and a wrench-turn, companies are finally seeing the ROI that simple predictive analytics never quite delivered.

40%

Service-related AI projects will fail by 2026, not due to technology, but because organizations tried to automate broken processes rather than redesigning them for agentic autonomy.

Monetizing the Software-Defined Asset

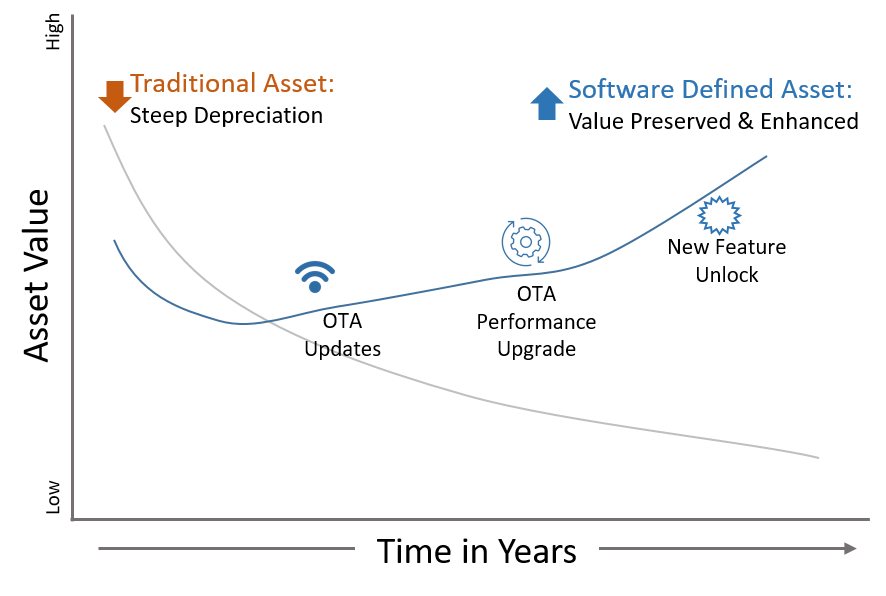

The move toward Software-Defined Vehicles (SDV) and assets has fundamentally rewired the economics of after-sales. When a “repair” is a firmware patch rather than a physical part replacement, the traditional “cost-plus” revenue model collapses. Service leaders must now view the software layer as a high-margin product.

In 2026, the most successful firms are selling Feature-on-Demand (FoD) and performance-based subscriptions, to enable Vehicle as a Service (VaaS). Whether it’s an over-the-air (OTA) update to increase a machine’s throughput or a safety patch for an autonomous fleet, these digital interventions represent nearly 100% margin revenue. The challenge for leaders is transitioning the sales force from selling “spare parts” to selling “digital performance enhancements” that extend the asset’s useful life.

Software-defined assets allow for “Continuous CLV.” Instead of the asset’s value depreciating the moment it leaves the factory, OTA updates allow the asset to improve over time, justifying premium service fees.

Industrial FinOps (Managing the Cost of Intelligence)

In the SDV world, ‘repairs’ move from the garage to the cloud. But every AI-driven diagnostic and OTA update carries a variable compute cost. Industrial FinOps brings financial accountability to these digital actions. It’s about answering one question: Is the digital fix more profitable than the physical failure?

The Resilient and Circular Service Supply Chain

The 2026 supply chain is no longer a linear path; it is a closed loop. Driven by both ESG mandates and the volatility of critical minerals, service leaders are integrating Remanufacturing into the heart of their operations. This is “Circular Service”, where every failed component is a raw material for the next repair.

Inventory intelligence in 2026 balances “Just-in-Time” with “Just-in-Case.” Using regional Micro-hubs and industrial 3D printing for “long-tail” parts, OEMs are eliminating the carbon and time costs of global shipping. By refurbishing high-value components (like EV batteries or high-precision servos) and re-introducing them into the service pool, companies are protecting their margins against the rising costs of raw materials.

45%

of G2000 OEMs will use AI to close the loop between field service data and engineering design, effectively turning the repair shop into a R&D lab by end of 2026.

Service Twins and the “Sovereignty” Conflict

The “Digital Twin” has evolved from a marketing visualization into a High-Fidelity Service Sandbox. In 2026, service leaders use these twins to simulate firmware updates in a virtual environment before pushing them to 10,000 units in the field, drastically reducing the risk of “bricking” expensive machinery.

However, this requires a new approach to data: Edge-Native Intelligence. As customers become more protective of their operational data (Service Sovereignty), leaders must deploy AI that lives on the machine. This “Sovereign AI” analyzes sensitive data locally to predict failures but only sends a high-level “health signal” to the OEM cloud. This builds the trust required to maintain deep service access in highly regulated or sensitive industrial environments.

Data privacy is no longer a legal hurdle; it is a competitive advantage. The firm that can provide “Zero-Knowledge Maintenance” will win the trust of the largest enterprise clients.

Leadership and the “Gig-Expert” Workforce

The talent shortage in manufacturing is no longer a trend; it is a permanent structural reality. By 2026, the service workforce has become a hybrid model of Field Hands and Teleporting Experts. Using Augmented Reality (AR) and real-time spatial computing, a single “Master Tech” in a central hub can provide “over-the-shoulder” guidance to five junior technicians across different continents. This model allows organizations to scale their highest-level expertise without the cost of travel. The cultural shift for leadership is moving from “supervising hours” to “orchestrating skill-access.”

Leadership must now manage a “gig-expert” ecosystem where specialized knowledge is disconnected from geography. The CSO must now have a seat at the product design table. Design-for-Service ensures that 2027’s products are easier to fix, cheaper to monitor, and natively compatible with the VaaS business models of the future.

As per Forrester, human expertise will rival AI in appeal by 2026. As AI handles the ‘what’ and ‘how,’ the most successful service leaders will focus their human talent on the ‘why’, managing the high-stakes customer relationships that machines cannot.

Conclusion: The 2026 Resilience Audit

To thrive in 2026, service leaders must move beyond traditional budget management and adopt Industrial FinOps. In a world of software-defined assets and autonomous agents, the cost of service is no longer just about diesel, spare parts, and labor hours; it is increasingly defined by the Industrial FinOps (Unit Economics of Intelligence).

Adopting an Industrial FinOps mindset means managing “Inference Costs”, the computational expense of running AI agents and digital twin simulations, as strictly as you once managed physical inventory. Success in this new era is no longer measured simply by how many machines were fixed. Instead, the ultimate KPIs are how much downtime was prevented, how effectively compute costs were aligned with real-time revenue, and how much Customer Lifetime Value (CLV) was protected.

The service leaders of 2026 are no longer just “fixers.” They are financial architects who ensure that the digital intelligence keeping the world running doesn’t cost more than the value it creates.

In 2024, the biggest overhead for service leaders was likely unutilized spare parts. In 2026, it is Idle Inference – paying for high-performance AI models that are monitoring healthy machines. Industrial FinOps is the art of scaling your digital ‘brains’ in lockstep with your fleet’s needs.