After-sales service in manufacturing and automotive is not a single function but a lifecycle capability that spans planning, execution, and commercial ownership. It has become one of the most important yet the least coherently managed function in manufacturing and automotive organizations.

Product differentiation is narrowing, margins on equipment and vehicles are under pressure, and customer expectations around uptime, responsiveness, and reliability continue to rise. At the same time, manufacturers and automotive OEMs are sitting on large, complex installed bases that represent recurring revenue, long-term customer relationships, and significant operational risk.

Yet despite this strategic importance, after-sales service in many organizations remains fragmented. Strategy, execution, KPIs, and technology often evolve independently, leading to situations where service organizations are busy, systems are live, dashboards are full, but outcomes still remain unchanged.

This page lays out an end-to-end view of manufacturing and automotive after-sales service: what it actually includes, why it matters now more than ever, how it is typically organized, where execution breaks down, and how digital and AI fit into the picture in practice.

What After-Sales Service Really Means in Manufacturing and Automotive

In manufacturing and automotive contexts, after-sales service refers to the full lifecycle of activities required to keep sold products, vehicles, or assets operating as intended throughout their usable life.

This lifecycle is fundamentally different from service in consumer or software industries. Assets are long-lived, failure modes are complex, safety and regulatory requirements are non-negotiable, and value is realized over years rather than transactions.

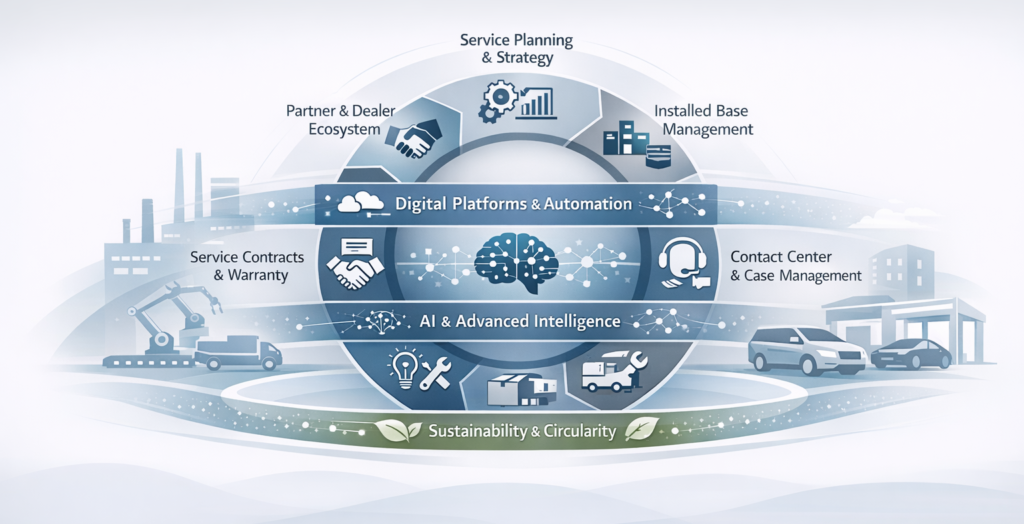

After-sales service typically spans:

- Service planning and lifecycle strategy

- Installed base and asset visibility

- Customer contact and case management

- Field service and repair execution

- Parts and logistics coordination

- Service engineering and technical knowledge

- Contracts, warranty, and commercial models

- Partner and dealer ecosystems (especially in automotive)

A common source of confusion is the tendency to collapse all of this into “field service” or “customer service.” Field service is an execution component. Customer service focuses on interaction and communication. After-sales service is the business capability that integrates strategy, execution, commercial models, and supporting technology.

When these distinctions are blurred, organizations often optimize one layer while creating friction elsewhere, for example organizations improving dispatch efficiency while worsening first-time fix rates or contract profitability.

Why After-Sales Has Become a Strategic Priority

The renewed focus on after-sales service is not accidental. It is driven by a combination of structural and market forces that affect both manufacturing and automotive organizations.

- First, product margins have compressed across most industrial and automotive segments. As products become more standardized and competition intensifies, service increasingly carries the burden of profitability and differentiation.

- Installed bases have grown significantly. Equipment lifespans are extending, vehicle parc sizes are increasing, and customers expect OEMs to support assets long after the initial sale. This shifts value creation from point-of-sale to lifecycle performance.

- Customer expectations have changed. Uptime, response time, and resolution quality are no longer “service metrics”, rather they are core contributors to brand perception, renewal decisions, and long-term loyalty. In automotive, this is amplified by safety, recall management, and regulatory scrutiny. In industrial manufacturing, it is reflected in production continuity, contractual penalties, and downstream customer impact.

- Service revenue is more predictable than product revenue. Contracts, maintenance agreements, and recurring services smooth volatility, but only when they are executed consistently and governed well.

Despite this, many organizations still treat after-sales as a cost center or operational necessity rather than a strategically designed system. The result is under-monetization, revenue leakage, and frustrated service teams.

Deep dives on service strategy

Common After-Sales Operating Models in Manufacturing and Automotive

Manufacturing and automotive companies rarely operate a single, uniform after-sales model. Instead, they evolve structures shaped by history, geography, product mix, and go-to-market strategy.

Some organizations centralize service planning, tools, and governance globally. Others delegate service ownership to regions, business units, or dealers. Many operate hybrids: centralized standards layered over decentralized execution.

Each model has strengths and predictable failure modes:

- Centralized models support consistency, data visibility, and global reporting. However, these models often struggle with local execution realities, skill availability, and response speed.

- Decentralized models offer speed, local responsiveness, and customer proximity. However, they tend to fragment processes, data, and KPIs, making performance comparison and optimization difficult.

- Partner-led models enable scale without proportional cost growth. These models are more common in automotive industry, but introduce challenges around control, incentives, and customer experience consistency.

Each also has predictable failure modes.

In diversified manufacturers with multiple business units, the problem is amplified. Applying a single operating model across businesses with different asset criticality, service economics, and customer expectations almost always creates friction.

Effective after-sales organizations accept that no single model fits all contexts. Instead, they define clear decision rights, minimum standards, and governance mechanisms that allow variation without chaos.

Deep dives on service structure & execution

KPIs That Matter and Why They Often Fail

After-sales organizations are not short on metrics. They are often drowning in them. Common KPIs include first-time fix rate, mean time to repair, asset uptime, SLA compliance, technician utilization, and cost-to-serve. These metrics are all valid, but in the right context.

The problem is not measurement. It is misalignment.

KPIs frequently fail because they are:

- Selected without regard to the operating model

- Used for reporting rather than decision-making

- Incentivized in isolation, creating conflicts

For example, maximizing technician utilization can undermine first-time fix rates. Reducing mean time to repair may increase repeat visits. Improving SLA compliance may increase service cost disproportionately. In practice, KPIs should reflect service maturity and strategic intent. Early-stage organizations benefit from stability and visibility metrics. Mature organizations focus on outcome-based indicators such as uptime, availability, and contract profitability.

One of the most common mistakes organizations make is adopting KPI sets based on industry benchmarks or peer comparisons without understanding the context in which those metrics were designed. Metrics that work well for a centralized, OEM-led service organization can create unintended consequences in decentralized or dealer-driven models.

Benchmarking can be useful, but only when it is used as a reference rather than a target. Manufacturing and automotive service organizations vary widely in asset criticality, service mix, regulatory exposure, and execution ownership. An asset uptime or cost-to-serve that appears “below benchmark” may reflect deliberate trade-offs rather than poor performance. Without this context, KPI programs tend to drive reporting activity instead of operational improvement.

Dashboards alone do not improve performance. Improvement happens when metrics are tied to operational levers, governance forums, and accountability structures.

Deep dives on service KPI

- Field Service KPI Framework & Dashboard Guide

- Why Uptime is the key KPI in Service

- Predictive vs Preventive Maintenance

Where After-Sales Execution Breaks Down

Most after-sales challenges are not caused by poor strategy. They are caused by execution friction that accumulates over time.

Common breakdown points include fragmented systems, inconsistent master data, limited visibility into the installed base, and weak feedback loops between field service and engineering. In many organizations, service engineers repeatedly solve the same problems because knowledge is not captured or reused.

Another recurring issue is change-fatigue. Large transformation programs often deliver early wins during system rollout, only to stall after the first year (or phase) or two. Processes are technically standardized, but behaviors remain unchanged. Metrics are tracked but not acted upon. Frontline teams perceive transformation as additional work rather than enablement.

Incentives also play a role. When service teams are measured on speed while sales teams are measured on revenue, and warranty teams on cost containment, misalignment becomes inevitable. These breakdowns are rarely visible in high-level dashboards. They surface in repeat visits, contract leakage, customer dissatisfaction, and rising service cost.

Deep dives on service KPI

The Role of Digital Platforms and AI

Digital platforms and AI have an important role to play in modern after-sales service, but their impact is often misunderstood.

FSM platforms excel at orchestration: work management, scheduling, visibility, and standardization. They create a foundation for scale and consistency. They do not, by themselves, resolve poor data quality, unclear ownership, or misaligned KPIs.

AI can add value in targeted areas: intelligent triage, knowledge management, remote diagnostics, and self-service deflection. These use cases work best when underlying processes are stable and data is reliable.

Many organizations experiment with AI pilots but struggle to scale them. The limiting factor is rarely the algorithm. It is readiness – business case applicability/ ROI, data completeness, operational discipline, and change adoption.

Technology amplifies service maturity. It rarely creates it.

Deep dives on AI and Platforms

- How AI Can (Actually) Help After-Sales Service

- Agentic AI in After-Sales: The Missing Execution Layer

- Platform of Platforms: Why Individual Tools Aren’t Enough

What Good After-Sales Service Looks Like

High-performing after-sales organizations evolve along a recognizable path.

Early stages are reactive, focused on break-fix and incident response. As maturity increases, organizations introduce preventive maintenance, followed by predictive approaches that use data to anticipate failure.

At the most advanced stage, service is outcome-driven. Contracts are structured around uptime, availability, or performance. Decision-making is proactive rather than reactive. KPIs focus on value creation rather than activity volume.

What distinguishes mature organizations is not tool sophistication, but clarity of ownership, alignment of incentives, and disciplined execution. Technology supports these capabilities; it does not substitute for them.

How Leaders Should Think About After-Sales Transformation

After-sales transformation is not a single program or platform implementation. It is a continuous effort to align strategy, execution, commercial models, and technology.

Leaders who succeed approach after-sales as a system:

- Strategy defines intent and priorities

- Operating models determine how work gets done

- KPIs guide behavior and trade-offs

- Technology enables scale and insight

Improvement comes from strengthening the connections between these elements, not optimizing them in isolation.

Closing Perspective

Manufacturing and automotive after-sales service is complex because it sits at the intersection of engineering, operations, commercial models, and customer experience. Simplifying it into tools, dashboards, or isolated initiatives almost always leads to disappointment.

Organizations that treat after-sales as a deliberately designed capability, grounded in operational reality and enabled by technology, unlock both resilience and growth. The organizations that succeed are not those with the most tools or metrics, but those that deliberately align intent, operating models, and decision-making across the service lifecycle.