Many organizations are sitting on a $100M+ revenue opportunity without realizing it. Hidden in your installed base are untapped levers such as service contracts, asset lifecycle data, parts sales, and upsells, that can dramatically improve margins. This article explores how senior leaders can leverage asset insights to unlock new growth while reducing risk and costs.

The Overlooked Goldmine

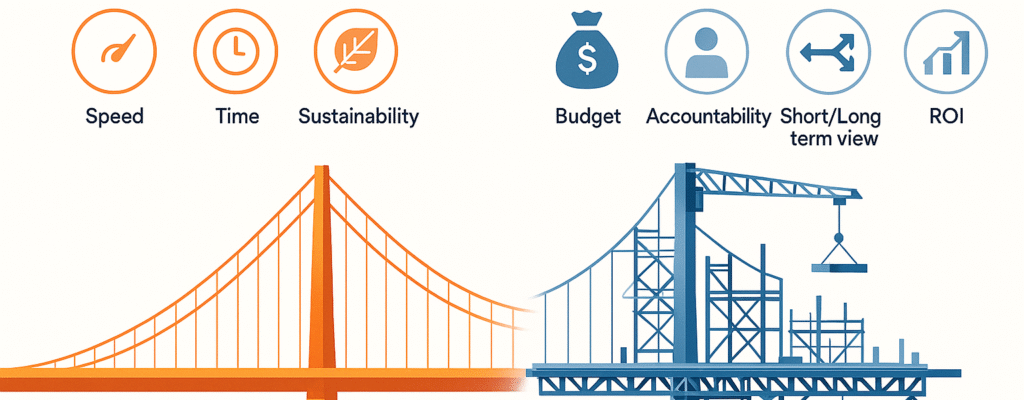

In most industrial organizations, leadership attention and capital investments are directed toward winning new customers, launching new products, or breaking into new markets. While these strategies are essential, they often overshadow a more immediate, high-margin revenue source: your installed base.

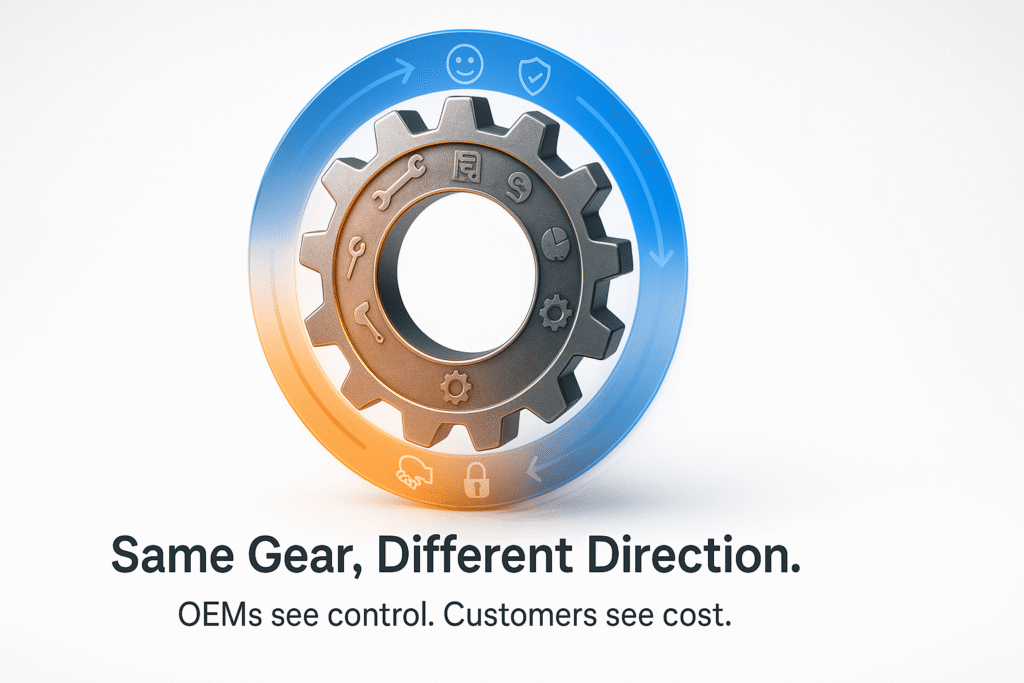

In the aftermarket space, many organizations today are prioritizing cost optimization, faster service delivery, digital self-service portals, and predictive maintenance – all of which are important – but they often focus less on systematically monetizing the installed base through lifecycle revenue strategies. The result: they make operational improvements without fully unlocking the financial upside sitting in front of them.

For many manufacturers, the installed base represents millions of active assets – equipment already in the field, already trusted by customers, and already producing valuable operational data. And yet, in many cases, 80% of its potential revenue impact goes untapped.

Business Case for Unlocking the Installed Base

When viewed through a financial lens, the numbers are striking:

- Service contract attach rates in many industries average just 25–30%. Best-in-class companies exceed 60%.

- Service gross margins are typically 2–3x higher than product margins.

- Parts and consumables often generate 40–60% margins without new customer acquisition costs.

- Asset lifecycle tracking enables recurring revenue through upgrades, retrofits, remanufacturing, and planned replacement programs.

C-level leaders understand ROI. The question isn’t whether the opportunity exists -it’s how quickly it can be captured.

Case in point :

For a $1B product manufacturer, a 10% lift in attach rates alone can drive $50–$100M in incremental, high-margin service revenue.

Combine that with parts mix optimization, proactive obsolescence management, and premium advisory services, and the total value expands 2–3x.

The compounding effect comes from improved asset visibility, tighter lifecycle control, and better alignment between service, sales, and supply chain.

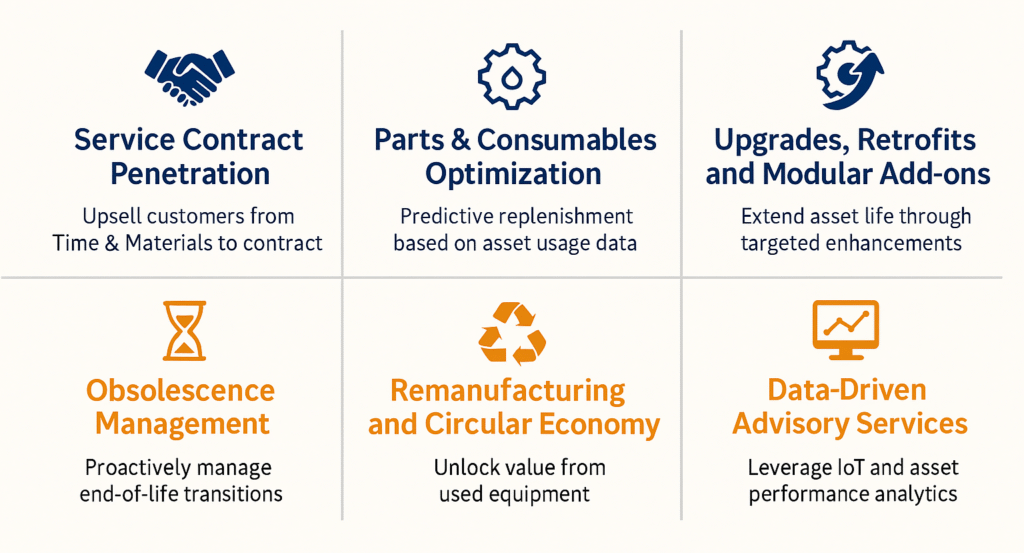

Six Untapped Revenue Levers in the Installed Base

These are the areas where leading manufacturers are quietly driving millions in high-margin growth. Each lever -from boosting contract attach rates to monetizing equipment obsolescence – represents an immediate, measurable opportunity. Miss one, and you’re leaving profit on the table.

Quick Wins: Where to Start Unlocking Value

Here are six proven levers you can pull today to start capturing the untapped revenue in your installed base

- Audit Service Contracts – Identify under-covered assets and upsell renewals.

- Leverage Asset Lifecycle Data – Spot upgrade, refurbishment, and end-of-life triggers.

- Optimize Spare Parts Pricing – Adjust based on usage patterns and customer criticality.

- Launch Targeted Upsell Campaigns – Cross-sell add-ons to existing customers.

- Monetize Obsolescence – Offer replacements or remanufactured options.

- Re-engage Dormant Customers – Use service history to win them back.

Case Study: From Fragmented Insight to a $500M Pipeline

A diversified global manufacturer with over five distinct business units – spanning industrial automation, building solutions, and energy and sustainability solutions -faced a common problem: siloed asset data.

Each unit had service records, warranty databases, and sales histories, but no consolidated view of the installed base.

By implementing centralized asset lifecycle tracking and advanced analytics, they:

- Mapped over 6 million active assets worldwide.

- Identified under-serviced contract opportunities.

- Flagged assets without a contract, tracked obsolescence, and created sales opportunities.

- Created a single view for executives to monitor insights and drive upsell/ cross-sell opportunities.

Within 12 months, the organization uncovered over $500M in actionable opportunities – and initiated targeted campaigns to capture them.

The Cost of Inaction

Ignoring your installed base isn’t a neutral decision – it’s a competitive risk.

- Revenue leakage: Competitors targeting your customers with better service offers.

- Margin erosion: Declining service attach rates over time.

- Customer churn: Customers replace your assets with a competitor’s when you’re absent from the lifecycle conversation.

Over a 3–5 year period, this can mean hundreds of millions in lost EBITDA.

Value-First Roadmap for Leaders

- Audit Your Installed Base Data – Assess what you currently know about your customer assets, contracts, service history, and performance metrics. Identify gaps and inconsistencies.

- Segment and Prioritize – Rank customers and assets by revenue potential, service risk, and upsell readiness.

- Identify Use Cases & Technology Enablers – Define the highest-value aftermarket use cases (e.g., predictive maintenance, automated renewal alerts, parts lifecycle management) and map them to the IT tools, platforms, and integrations required for execution.

- Build the Business Case – Quantify potential ROI, margins, and cost of inaction to secure executive buy-in.

- Pilot, Learn, and Scale – Start with a high-impact, measurable initiative, refine the approach, then scale across the business.

- Integrate with Core Strategy – Embed installed base monetization into your broader service and growth strategies for long-term impact.

Final Thoughts

Your installed base is not a static record – it’s a living, revenue-generating portfolio. Managed strategically, it can be the fastest path to $100M+ growth without adding a single new customer.

For executives and industry leaders, the imperative is clear: look inward before you look outward. The opportunity is already in your hands – if you know where to look.

If unlocking hidden revenue from your installed base is a priority, you’ll want to ensure your organization avoids the common pitfalls outlined in 5 Strategic Mistakes That Are Sabotaging Field Service Success in 2025 and aligns with the market shifts explored in The State of Field Service in 2025.