This is the fourth article in our KPI Deep Dive series, where we explore the metrics that define success in manufacturing and automotive after-sales service. After examining operational KPIs such as First Time Fix Rate (FTFR) and Mean Time to Repair (MTTR), and forward-looking metrics like Proactive Resolution Rate (PRR), we now turn to a foundational strategic indicator:

Installed Base Coverage Rate (IBCR). If FTFR measures how well you fix and PRR measures how well you prevent, IBCR measures something even more structural:

How much of your installed base are you actively monetizing and managing?

For a broader view of how this KPI fits within the full performance architecture, see Field Service KPIs for Manufacturing & Automotive: Metrics That Actually Drive Performance

What It Really Measures

Installed Base Coverage Rate measures the percentage of total installed assets that are covered under an active service contract (service contract penetration), monitoring agreement, or structured service relationship.

IBCR = (Number of Covered Installed Assets ÷ Total Installed Base) × 100

“Covered” typically includes assets that are:

- Under active service contract

- Under uptime or outcome-based agreement

- Digitally monitored or connected

- Formally registered within your service management ecosystem

IBCR is not a technician KPI. It is a portfolio-level strategic KPI that reflects how much of your installed base is commercially secured and operationally visible.

An uncovered asset may still generate reactive revenue. But it does not generate predictable revenue, structured lifecycle engagement, or long-term margin stability.

Installed Base Coverage Rate therefore measures both commercial penetration and strategic control.

Why it Matters

Industry research consistently shows that service businesses with higher contract penetration demonstrate more stable margins and stronger customer retention than reactive models.

Service Revenue Is the Target, Coverage Is the Mechanism

Most large manufacturing organizations are actively pursuing service-led growth, but few can quantify how much of their installed base is actually under structured coverage. They want recurring revenue, margin stability, and reduced dependence on cyclical equipment sales.

But service revenue does not scale automatically. Installed Base Coverage Rate is the mechanism that ensures service revenue becomes consistent rather than incidental. When assets are under contract or monitoring:

- Revenue becomes predictable

- Renewal cycles can be managed

- Upsell opportunities are systematic

- Lifecycle engagement deepens

Without tracking IBCR, service revenue ambition remains conceptual. With IBCR, it becomes measurable.

Monetization of the Installed Base Is Becoming Strategic

Across industrial sectors, executives increasingly recognize that the installed base represents a long-term revenue annuity. Many organizations are now moving toward:

- Lifecycle service models

- Outcome-based contracts

- Digital monitoring subscriptions

- Installed base expansion campaigns

As this shift accelerates, installed base tracking becomes critical. If you cannot quantify how much of your base is covered, you cannot quantify how much of your future revenue is secured.

IBCR makes installed base monetization visible at the leadership level.

Coverage Enables Proactive Service

There is also a direct relationship between IBCR and Proactive Resolution Rate (PRR).

You cannot proactively prevent failures on assets that are:

- Not under contract

- Not digitally connected

- Not properly registered in your systems

IBCR is the structural prerequisite for proactive, AI-enabled service maturity. If PRR measures how often you prevent failure, IBCR determines how many assets you have the right and ability to prevent failure on.

Why ICBR Increases, and How to Improve It

Installed Base Coverage Rate often stalls not because of technology limitations, but because of structural misalignment.

In many organizations, product sales and service coverage are still treated as separate motions. Equipment is sold, but installed base registration is incomplete. Contracts are attached inconsistently. Renewal processes lack discipline. Over time, assets quietly fall out of coverage.

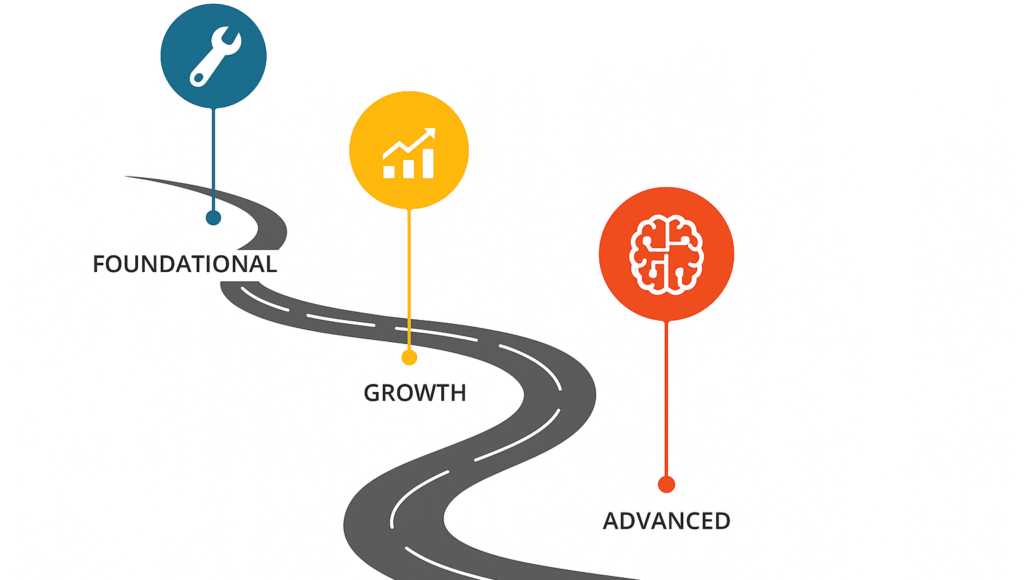

Improvement requires coordinated action across people, process, and systems. IBCR increases when coverage growth is treated as a managed program rather than a by-product of sales.

Improving IBCR requires structural alignment across the organization. Most coverage gaps are not accidental, they are systemic.

People

- Leadership must align incentives so that contract attachment and renewal are strategic priorities, not secondary metrics.

- Sales, service, and account teams need shared ownership of lifecycle revenue rather than isolated product targets.

Process

- Installed base registration must be standardized at the point of sale. Renewal tracking should be systematic, not manual.

- Lifecycle touchpoints (warranty expiration, major service events, product upgrades) should be leveraged to expand coverage.

Technology

- Accurate installed base management requires integration across CRM, ERP, and field service systems.

- Asset master data must be treated as a managed asset.

- Digital monitoring initiatives should be linked directly to coverage tracking.

What Good Installed Base Coverage Looks Like

There is no universal benchmark for Installed Base Coverage Rate. Acceptable coverage varies by industry, asset complexity, and service model maturity.

However, mature organizations demonstrate:

- Clear visibility into total installed base

- Segment-level coverage tracking

- Steady year-over-year improvement

- Direct linkage between coverage growth and service revenue growth

IBCR should not be viewed as a static percentage. It is a strategic growth indicator that reflects the strength of your lifecycle business model.

Related Metrics

Installed Base Coverage Rate connects directly to several other KPIs:

- First Time Fix Rate (FTFR) – execution quality on covered assets

- Mean Time to Repair (MTTR) – operational efficiency

- Proactive Resolution Rate (PRR) – preventive maturity

- Service Revenue Ratio – share of recurring revenue

- Service Gross Margin – profitability discipline

For a full cross-role breakdown, see The Field Service KPI Dashboard: What Executives, Managers & Technicians Should Really Track

Together, these metrics provide a holistic view of service performance, balancing speed, quality, cost, and customer impact.

Operational excellence improves response. Proactive excellence prevents failure. But Installed Base Coverage determines whether you control the lifecycle at all.

If service revenue is the goal, installed base coverage is the foundation. In a service-led growth model, installed base coverage is not an operational detail, it is a strategic asset. Installed Base Coverage Rate makes that asset visible.